ISLAMABAD, Jan 20 (APP):The government on Friday revised up the rates of return for various currencies denominated Naya Pakistan Certificates over different maturities for the resident Pakistanis who have a Foreign Currency Roshan Digital Account.

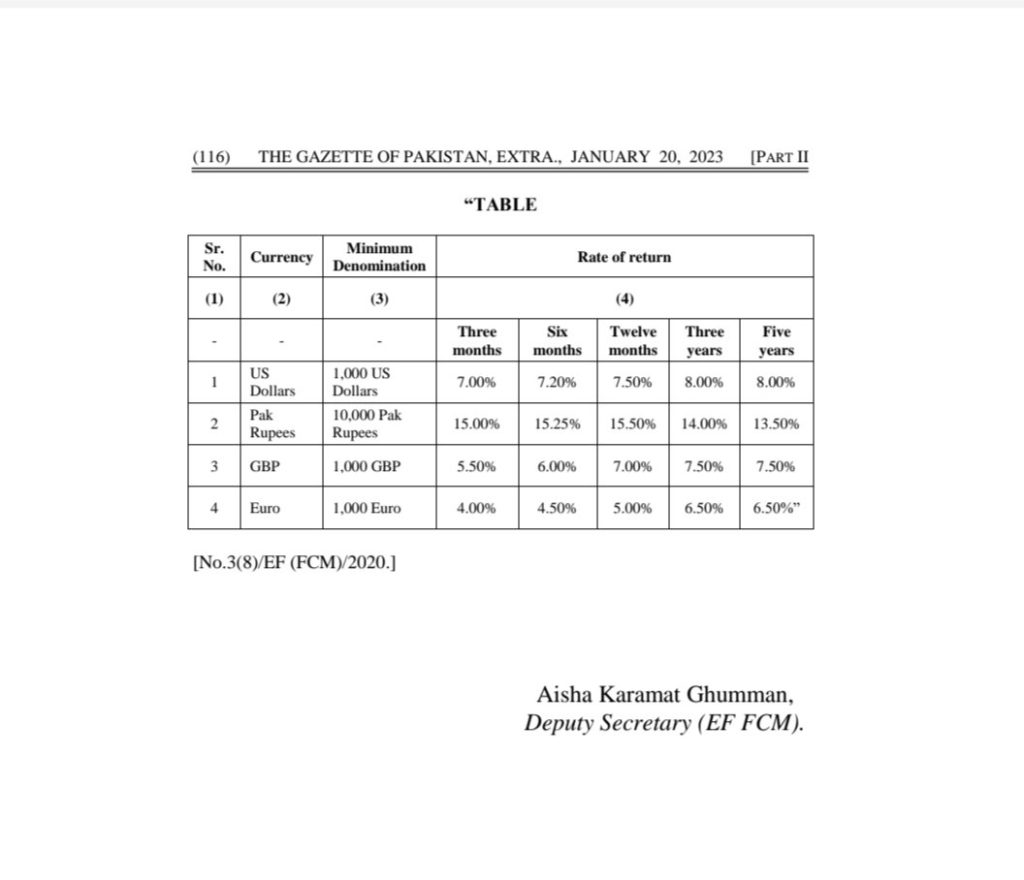

According to a notification issued by the Finance Division, the rate of return for US dolalr denominated Naya Pakistan Certificates (NPCs) with maturity of three months has been revised up from previous 5.5% to 7.00% while that with maturity period of six month has been raised from 6.00% to 7.20%.

The rate of return for a period of one year has been revised up from 6.5% to 7.5% while that for a period of three years and five years has been increased to 8% whereas the previous rate of return was 6.75% and 7.00% respectively.

The government has mad no or very minor change in the rates of return for PKR denominated NPCs.

Similarly, the new rates for GBP denominated NPCs have been revised up to 5.5% for a maturity period of three months, 6.00% for six months, 7.00% for one year and 7.5% each for a period of three years and five years respectively.

For Euro denominated NPCs, the government has revised up the rates of returns to 4.00% for a maturity period of three months, 4.5% for six months, 5.00% for one year and 6.5% each for a period of three years and five years respectively.

Minimum investment for a foreign currency account is1000 in numbers and for PKR the minimum investment condition is Rs 10,000, the notification added.

Since the launch of NPCs in 2020, total inflows have been recorded at US$ 1.77 billion under conventional while US$ 1.72 billion under Islamic banking.

Whereas the inflow of remittances under Roshan Digital Account (RDA) rose to US $7.576 billion by the end of December 2022 as compared to US $5.436 billion by November end, according to the latest data released by the State Bank of Pakistan.

The data showed that the inflows of remittances during the month of December were recorded at US$ 140 million as compared to US$ 141 million in November and US$ 146 million in October 2022.

Roshan Digital Account (RDA) was launched by the State Bank of Pakistan in collaboration with commercial banks operating in the country.

These accounts provide innovative banking solutions to millions of Non-Resident Pakistanis (NRPs), including Non-Resident Pakistan Origin Card (POC) holders, seeking to undertake banking, payment, and investment activities in Pakistan.

The number of accounts registered under the programme also rose by 12,225 to 511,159 in December 2022 from 498,934 accounts in November 2022.

The scheme that started in September 2020 received a lukewarm response from overseas Pakistanis who deposited only US$ 7 million in the opening month, however with the passage of time the interest kept on increasing as the inflow reached US$ 40 million in October 2020 and US$ 110 million in the subsequent month.

Similarly, US$ 47 million were invested in the stock exchange compared to US$ 43 million by end of November 2022.