Today’s Latest

APP’s Top News Today

Fri, 26 Apr 2024, 12:20 AM

Thu, 25 Apr 2024, 11:31 PM

Thu, 25 Apr 2024, 11:56 PM

Thu, 25 Apr 2024, 9:08 PM

Thu, 25 Apr 2024, 8:57 PM

Tue, 16 Apr 2024, 3:33 PM

Thu, 11 Apr 2024, 11:53 AM

Mon, 1 Apr 2024, 2:37 PM

Thu, 25 Apr 2024, 10:33 PM

Thu, 25 Apr 2024, 10:23 PM

Thu, 25 Apr 2024, 9:55 PM

Wed, 24 Apr 2024, 7:19 PM

Wed, 24 Apr 2024, 4:28 PM

Tue, 23 Apr 2024, 10:04 PM

Sat, 20 Apr 2024, 10:31 PM

Useful Links

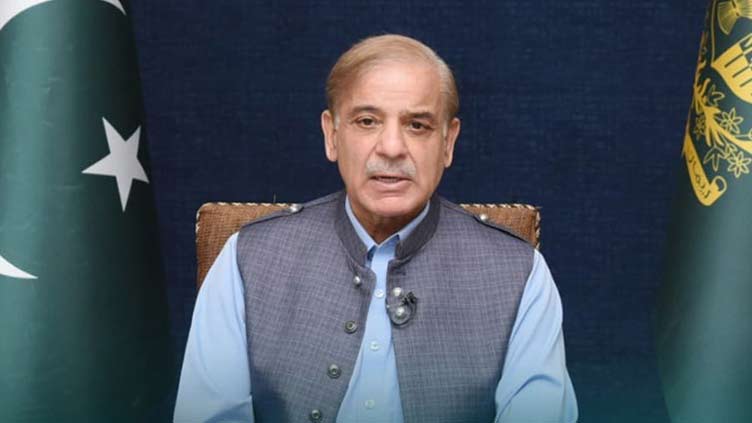

Prime Minister Muhammad Shehbaz Sharif in a group photo with the high achiever women and girls in the field of IT

APP95-250424ISLAMABAD: April 25 -

New Zealand players celebrate the wicket of Pakistan batter Usman Khan (caught by Duffy balled by Sears) during the Fourth Twenty20 International Cricket Match between Pakistan and New Zealand at the Qaddafi Cricket Stadium

APP88-250424LAHORE: April 25 - . APP89-250424LAHORE: April 25 – Pakistan batter Fakhar Zaman plays a shot during the Fourth Twenty20 International Cricket Match between Pakistan and New Zealand at the Qaddafi Cricket Stadium. APP/MTF/IQJ/ABB APP90-250424LAHORE: April 25 - New Zealand players celebrate the wicket of Pakistan batter Saim Ayub (caught by Clarkson balled by O'Rourke)… Continue reading New Zealand players celebrate the wicket of Pakistan batter Usman Khan (caught by Duffy balled by Sears) during the Fourth Twenty20 International Cricket Match between Pakistan and New Zealand at the Qaddafi Cricket Stadium

A delegation of the world’s leading shipping and logistics company A.P. Møller – Mærsk led by CEO of APM Terminals and board member of A.P. Møller – Mærsk Mr. Keith Svendsen call on Prime Minister Muhammad Shehbaz Sharif

APP87-250424ISLAMABAD: April 25 -